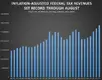

$2,883,250,000,000: Federal Taxes Set Record Through August; $19,346 Per Worker

by Terence P. Jeffrey | CNS News | September 14, 2015

Feds Still Run $530B Deficit.

(CNSNews.com) - The federal government raked in a record of approximately $2,883,250,000,000 in tax revenues through the first eleven months of fiscal 2015 (Oct. 1, 2014 through the end of August), according to the Monthly Treasury Statement released Friday.

That equaled approximately $19,346 for every person in the country who had either a full-time or part-time job in August.

It is also up about $198,425,330,000 in constant 2015 dollars from the $2,684,824,670,000 in revenue (in inflation-adjusted 2015 dollars) that the Treasury raked in during the first eleven months of fiscal 2014.

Despite the record tax revenues of $2,883,250,000,000 in the first eleven months of this fiscal year, the government spent $3,413,210,000,000 in those eleven months, and, thus, ran up a deficit of $529,960,000,000 during the period.

According to the Bureau of Labor Statistics, total seasonally adjusted employment in the United States in August (including both full and part-time workers) was 149,036,000. That means that the federal tax haul so far this fiscal year has equaled $19,345.99 for every person in the United States with a job.

In 2012, President Barack Obama struck a deal with Republicans in Congress to enact legislation that increased taxes. That included increasing the top income tax rate from 35 percent to 39.6 percent, increasing the top tax rate on dividends and capital gains from 15 percent to 20 percent, and phasing out personal exemptions and deductions starting at an annual income level of $250,000.

An additional 3.8 percent tax on dividends, interest, capital gains and royalties--that was embedded in the Obamacare law--also took effect in 2013.

The largest share of this year’s record-setting October-through-August tax haul came from the individual income tax. That yielded the Treasury $1,379,255,000,000. Payroll taxes for “social insurance and retirement receipts” took in another $977,501,000,000. The corporate income tax brought in $268,387,000,000.

by Terence P. Jeffrey | CNS News | September 14, 2015

Feds Still Run $530B Deficit.

(CNSNews.com) - The federal government raked in a record of approximately $2,883,250,000,000 in tax revenues through the first eleven months of fiscal 2015 (Oct. 1, 2014 through the end of August), according to the Monthly Treasury Statement released Friday.

That equaled approximately $19,346 for every person in the country who had either a full-time or part-time job in August.

It is also up about $198,425,330,000 in constant 2015 dollars from the $2,684,824,670,000 in revenue (in inflation-adjusted 2015 dollars) that the Treasury raked in during the first eleven months of fiscal 2014.

Despite the record tax revenues of $2,883,250,000,000 in the first eleven months of this fiscal year, the government spent $3,413,210,000,000 in those eleven months, and, thus, ran up a deficit of $529,960,000,000 during the period.

According to the Bureau of Labor Statistics, total seasonally adjusted employment in the United States in August (including both full and part-time workers) was 149,036,000. That means that the federal tax haul so far this fiscal year has equaled $19,345.99 for every person in the United States with a job.

In 2012, President Barack Obama struck a deal with Republicans in Congress to enact legislation that increased taxes. That included increasing the top income tax rate from 35 percent to 39.6 percent, increasing the top tax rate on dividends and capital gains from 15 percent to 20 percent, and phasing out personal exemptions and deductions starting at an annual income level of $250,000.

An additional 3.8 percent tax on dividends, interest, capital gains and royalties--that was embedded in the Obamacare law--also took effect in 2013.

The largest share of this year’s record-setting October-through-August tax haul came from the individual income tax. That yielded the Treasury $1,379,255,000,000. Payroll taxes for “social insurance and retirement receipts” took in another $977,501,000,000. The corporate income tax brought in $268,387,000,000.